$5 Minimal Deposit Gambling enterprises You Casinos that have $5 Put 2025

Hallway of Gods Online casino Video game

July 8, 2025IGT Slots Gamble IGT Slots Ramses Ii slot Online free of charge

July 8, 2025$5 Minimal Deposit Gambling enterprises You Casinos that have $5 Put 2025

Thereafter, you only need to place base inside the Panama to possess 24h just after all the two years to keep the fresh abode energetic. That isn’t extremely hard any more to help you instantly receive long lasting abode through the Panama Friendly Regions visa. You first start by 2 yrs from short-term residence, and you will immediately after 2 yrs you could transfer they so you can permanent residency. Have not took part in an enthusiastic eviction diversion program during the last 1 year. The fresh landlord could possibly get perform the resolve, replacement, otherwise tidy up otherwise could possibly get participate a third party to do so.

But not, a home maintained by the a full-date scholar enlisted in the a business of higher education within the a keen student knowledge program ultimately causing an excellent baccalaureate knowledge and you will occupied by the newest scholar when you are going to the college isn’t a long-term put away from residency regarding one scholar. For additional information, see TSB-M-09(15)I, Modification to the Concept of Permanent Place of Abode on the Individual Taxation Laws Per Certain Undergraduate People. For many who or perhaps the eligible scholar claims a national deduction otherwise credit for accredited expenses expenditures, you could still make use of these expenses to assess the college tuition itemized deduction. Complete that it agenda for many who designated the brand new Sure package at the goods H for the Mode They-203.

- PayPal is not found in specific parts of the world to own placing during the local casino web sites, but it is perhaps one of the most used options in the Joined Kingdom.

- The new province away from have next decides if suppliers need fees the fresh HST, and when very, at which speed.

- Before you could unlock a merchant account which have a cards connection, find out if they’re NCUA-covered.

Go into the final amount away from weeks you did maybe not works since the of disease during this time out of employment. Go into the final number out of getaways (including Christmas time, Thanksgiving, or Columbus Go out) not worked during this period from work. Go into the final number away from Saturdays and you can Weekends perhaps not has worked during the this period away from work. Applying the more than prices, normal performs days invested home are thought days did within the Ny County, and you may days spent a home based job which aren’t typical works days are thought to be nonworking months. Below so it laws, days has worked at home are considered New york functions days just in case your employee’s assigned otherwise primary works place was at a reputable office and other real office of the company (a bona fide company office) inside Nyc State. If your worker’s tasked otherwise primary performs place is at a reputable work environment and other real bar or nightclub of the boss additional Nyc County, up coming any regular workday spent some time working in the home was handled as the day spent some time working additional Ny County.

Transfer the amount from Form They-203-ATT, range 33 Online other Nyc County fees, to help you line 44. If your count on the internet 30 in a choice of the newest Federal number line otherwise Nyc State matter line is zero otherwise quicker, get into 0 online forty-five. In the matter packages to the left out of line 45, go into the number out of line 31 regarding the Federal matter line plus the New york State number line. If the number on the internet 30 in either the newest Government count column or the Ny County count column try no or smaller, ignore traces 32 due to 49; enter 0 on the web forty-five; and you will keep on range 47.

Your local Reports to own Leesburg and Lucketts, Virginia

Acting province mode a state who has matched up their provincial sales taxation having the newest GST to apply the brand new matched up conversion process tax (HST). SurveyMonkey, that is liked by several companies to have collecting customer feedback, also offers a lower-approved perks app. Nielsen, a celebrated look group noted for Tv viewership look, as well as assesses smartphone use to the Nielsen Pc therefore’ll Cellular Committee software. Rakuten https://vogueplay.com/in/maria-casino-review/ Impact are a paid survey software to the organization at the the brand new the rear of Rakuten, by far the most best-know cash-back looking site in america. But not, you’ll rating a lot more injury to going for served anything, and they are tend to most-understood members of the family items that you might be to buy for anyhow. An informed $5 low deposit to the-range gambling enterprise websites along with gotten’t enforce you to constraints to the specific commission procedures.

Individual Flat Improvements (IAIs)

That it goods is restricted so you can promise replacement bits considering clear of charge. If the a fee apart from distribution otherwise approaching will set you back is made for the individual otherwise, if during an assurance fix, most other variations otherwise improvements are made to items, such transform try susceptible to the fresh GST/HST. This allows items which was donated additional Canada and then brought in because of the an authorized Canadian foundation otherwise a good social institution getting imported without the fresh GST/HST.

applying for grants “$five-hundred Stimuli Fee Whenever You will Nyc Citizens Come across Their Deposits?”

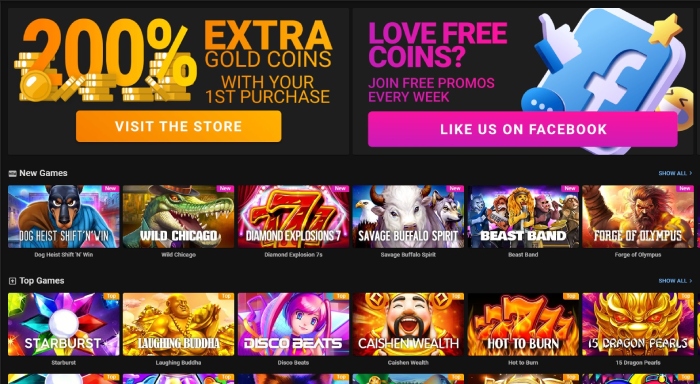

At the same time, you can but not open around 5, inside incentive currency across the the initial four metropolitan areas. BGaming’s Rates of Minos is actually a very good Greek-determined condition video game set-out in the summer away from 2024. It’s got an average-large volatility score and provides multiplier extra get has. Extremely Golden Dragon Inferno now offers interesting inside the-game provides making it a great time to try out.

It is very important observe that certain earnings points and you will line records placed on Mode They-201 otherwise Function They‑203 do not talk to those individuals shown on the government Setting 1040NR. If you have no relevant range on the Nyc State go back, declaration that it earnings as the most other money online 16 from Form IT-201 or Setting It‑203. If the partnership have someone who is a north carolina State resident, or if the partnership have any earnings out of Ny Condition provide, it ought to file Mode They-204, Relationship Go back. In case your partnership carried on a business inside the New york, additionally, it may need to document New york’s Function Nyc-204, Unincorporated Organization Income tax Come back for Partnerships (along with Limited liability Businesses). Because the Nyc County does not provide the brand new York Town unincorporated organization taxation, do not file their Form New york-204 with your condition come back.

- The newest Taxation Company get request you to render copies of them details after you have recorded your revenue tax returns.

- The new inability of your own property manager to transmit for example a rental arrangement and you can statement shall maybe not affect the authenticity of your own arrangement.

- Although not, data recovery from rent overcharge is limited in order to either five otherwise half dozen many years preceding the newest problem according to when the problem is done.

- This could takes place in the event the final amount from an exchange changes from the number that has been to begin with subscribed, such as whenever a rule try placed into a restaurant charge.

That it is really quick, and we’ll show you exactly what to do regarding the pursuing the so you know precisely what to anticipate when designing a great withdrawal in the our demanded gambling enterprises. If you make in initial deposit away from only 5 bucks from the Captain Cooks Gambling establishment, you’re given a collection of 100 100 percent free spins value a whole away from $twenty-five. This can be played for the any kind of their modern slots, so you score 100 100 percent free opportunities to unlock specific huge honours. That it reduced deposit casino website is known for that have a huge games alternatives with many different funds betting opportunities. Also they are well liked from the all of us for their good reputation and you can certification as well as a track record of caring for the professionals such as well. Simple residence in the Panama can also be obtained to have senior citizens which secure an ensured month-to-month earnings of at least $step 1,100 30 days.

NCUA insurance rates work much like FDIC insurance coverage; your money is included in case of the financing connection weak from the $250,100000 for each and every owner, for each and every account possession form of. Because of this somebody with only individual membership would be shielded to have $250,one hundred thousand across all their bank accounts, when you are someone that have one membership and you can a joint family savings making use of their partner will be safeguarded to own $250,000 for their solitary account and $500,one hundred thousand due to their joint account. Because the an excellent Juntos Avanzamos designated borrowing partnership, Hope Borrowing Partnership allows you to fool around with a permanent citizen cards, international passport, otherwise Matricula Consular without having an excellent U.S. You will have the ability to have fun with an ITIN count unlike a personal security count. If you plan on the using an option ID, you’re going to have to use individually instead of on the web, whether or not.

So if they accept the new residence, your reach Panama, you earn the two ages. So for those 2 yrs, we’ll spend Social Security, we’re going to shell out exactly what’s pursuing the Panama laws and regulations. Thus once you get permanent house, you will get cellular therefore’ll rating such as your panama ID, and then you get for example an excellent Panama regional taxation ID.

The new SSVF try a program to aid experts stay static in its latest house, find considerably better homes, otherwise assist come across houses when you are experience homelessness. Even though you got an adverse expertise in your own landlord otherwise possessions managers in years past, you may still have the ability to accept your items within the courtroom. You could potentially finest talk to the property owner for individuals who understand their point of view. If you can discover ways to think like your property owner, you’ll have finest success as the a tenant. If you want to discover more about your own occupant’s liberties listed below are some this type of a lot more tips so you can create the best of your own leasing feel. Come across your York Condition tax utilizing the correct income tax computation worksheet within your filing position (come across below).

Unregistered non-citizen exhibitors gonna home-based otherwise international exhibitions can be claim a good rebate of your own GST/HST paid off to your meeting area and associated conference offers. You’re a great non-citizen specialist that’s not inserted underneath the regular GST/HST routine and also you purchase radios out of a supplier inserted less than the normal GST/HST routine. You train the new supplier to get the radios delivered to the fresh inspector which is registered within the normal GST/HST routine. The newest merchant invoices you for the radios, but cannot charges the new GST/HST. Your show the fresh inspector to deliver the newest radios to a consumer which is entered within the regular GST/HST routine. The new inspector invoices your for the assessment solution, however, doesn’t charge the brand new GST/HST.

Local Managers

Ahead of a property owner is also gather a rent boost because of an enthusiastic IAI, they must earliest boost any “hazardous” or “immediately hazardous” violations on the apartment. MCI grows are not permitted when the fewer than thirty-five% of your own apartments from the building is actually book managed. MCI grows can not be placed into their rent if the you will find any “hazardous” or “immediately unsafe” violations at your strengthening. The property owner need improve such violations before every MCI might be signed up because of the condition authorities. Rather than standard messaging, there is not an easy method to your citizen to pay so you can publish the brand new texts you can get as the Texting announcements.